Ali quartz notice — U.S. kitchen-and-bath professionals foresee a continuing slowdown of the market, according to a new industry study.

The Kitchen & Bath Market Index (KBMI) for the third quarter of this year shows a decrease in optimism about current conditions and future growth. The study, conducted by the National Kitchen and Bath Association (NKBA), still reflects a positive outlook on the market, albeit with less than a ringing endorsement.

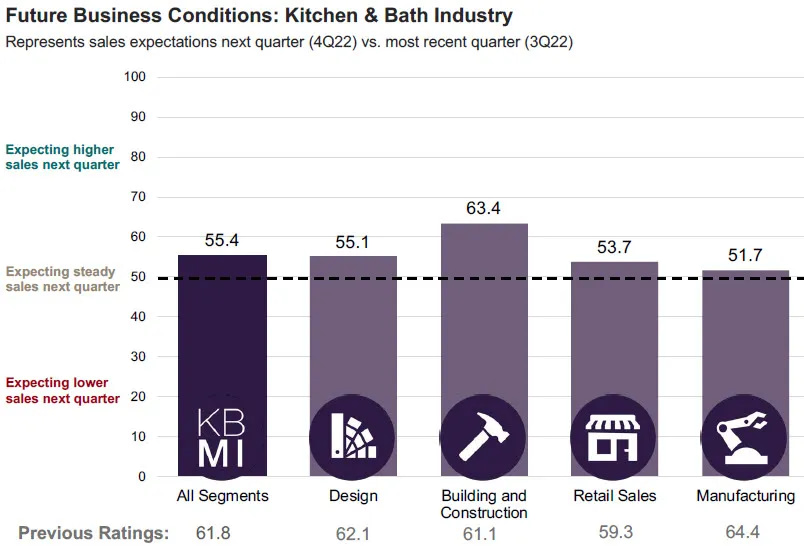

The overall market index of 63.2 is the lowest it has been since the third quarter of 2020, and it has fallen from a high of 82.3 in the first quarter of 2021. The future conditions rating of 55.4 remains significantly higher than the first-quarter 2020 miasma of 19.8, but it is significantly lower than the 78.6 reported in the first three months of this year.

Both the overall and future-condition indexes indicate that industry professionals believe the current economic slowdown will continue.

The quarterly KBMI report assesses the overall health of the kitchen and bath industry, as well as the issues and challenges that industry professionals face in their businesses. On a scale of 100, KBMI ratings above 50 indicate industry growth, while ratings below 50 indicate slowing activity.

While third-quarter 2022 ratings remained above 50 in all segments (Design, Building & Construction, Retail Sales, and Manufacturing), lower levels reflect industry adjustments as consumer demand slows and recession fears grow.

Furthermore, the third-quarter 2022 KBMI indicated a 1.3% increase in full-year 2022 sales expectations, compared to 9.4% growth expectations only three months earlier – this after two banner years of gains despite formidable obstacles.

According to the study, 75% of building and construction firms contacted now report cancellations/postponements, a 29% increase from the first quarter of 2022; 65% of design firms report the same trend, a 17% increase from January to March this year.

In the recent study, 41% of respondents were designers, 22% were retailers, 20% were manufacturers, and 16% were building/construction professionals.

“While the index remains above 50, which continues to indicate expansion, there is understandable concern around current and predicted economic conditions, and the potential impact on the kitchen and bath industry leading into 2023,” said Bill Darcy, NKBA CEO.

“One lesson we have all learned over the past two years, however, is that adaptability is the key. For instance, we see it with design firms currently leveraging new brands for better lead times and availability – as well as those who feel their businesses are well-prepared and positioned to meet the challenges of an economic slowdown.”